5 Perks of Providing a Section 125 Premium Only Plan (POP)

February 22nd, 2023 | 4 min. read

In a day and age where extreme couponing graces the channels of our TV guides, the reality is that we are all looking for ways to save our hard-earned dollars.

As an employer, you’re no stranger to this notion.

While you may not be cutting coupons to cash in at the grocery counter, you are continuously creating strategies to boost your bottom line.

Well, what would you say if I told you that providing a POP plan can help you do that and more?

Here at Combined, our benefits experts want to teach you how a better benefits package can actually save you a bundle. With many years of field experience, our team can help you assemble the best benefits program for your business.

In this article, we will explore everything you need to know about POP plans. By reading it, you will learn 5 perks of providing a Section 125 Premium Only Plan (POP) to your employees.

What is a POP plan?

A POP plan is a pre-tax approach for employees to pay their health care coverage premium contribution.

In other words, a POP plan allows employees to deduct their coverage contribution from their gross income before it is taxed.

So, instead of taxes being withdrawn from their full income, they are only taxed on the income that remains after their coverage contribution has already been taken out.

5 perks of providing a POP plan

A POP plan can benefit you, your employees, and your overall workplace.

Here are the top 5 perks of providing a POP plan.

1. A POP plan can save your employees in taxes

By following a timeline where a coverage deduction is made before taxes are taken out, your employees save tax dollars.

Let’s simplify it with some easy math.

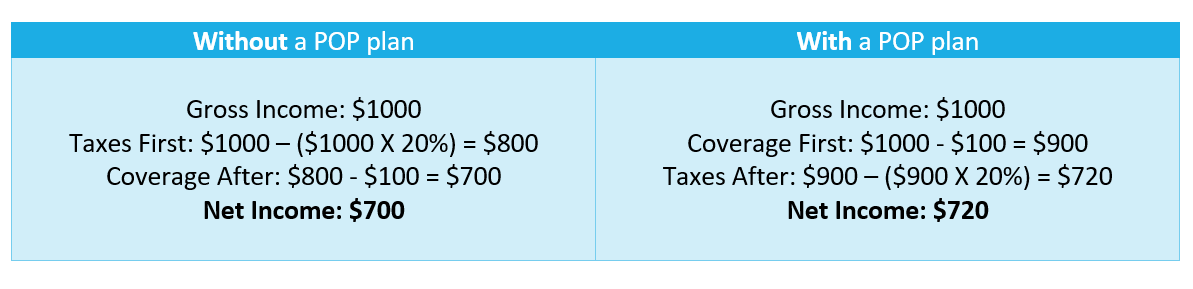

Say you make $1000 monthly in a 20% tax bracket and have a $100 per month coverage premium contribution:

Without a POP plan in place, your income would first be adjusted for taxes, so your gross $1000 would become $800 after taxes are taken out. Then, your coverage contribution would be deducted, leaving you with a monthly net income of $700.

With a POP plan in place, your health care coverage contribution would be deducted first, leaving you with $900 of taxable income. Then, this $900 figure would be adjusted for your 20% tax rate, becoming a monthly net income of $720. I don’t know about you, but given the option of $700 vs. $720, I would gladly take the extra Jackson down to Starbucks and let Uncle Sam foot the bill.

I don’t know about you, but given the option of $700 vs. $720, I would gladly take the extra Jackson down to Starbucks and let Uncle Sam foot the bill.

And as an employee, I would thank my employer for those POP plan tax savings down to the last drop of my triple shot iced latte.

2. A POP plan can lower your payroll tax liability

By providing a POP plan, your employees won’t be the only ones with tax-related savings – as their employer, you will spare yourself in payroll tax liability.

When an employee signs your contract of employment, there is an exchange of responsibility:

- They accept the responsibility to work for you

- You accept the responsibility to calculate and withhold their taxes (Income tax, Social Security tax, Medicare tax, etc.) and pay the government taxes on their behalf

With great employer power, comes great employer responsibility – in this case, it is called tax liability.

In simple terms tax liability means that, if you fail to correctly calculate, withhold, and pay employee taxes, you are to blame. And fault with the IRS means fees, fines, and financial loss for you. So, having less tax liability is favorable.

Because a POP plan accounts for employee coverage contributions before taxes are deducted, your employees’ taxable incomes are lower. So, as an employer, the payroll tax withholdings you are responsible for are also lower.

In effect, a POP plan reduces your payroll tax liability.

3. A POP plan can make better coverage more affordable for your employees

Most people play an endless game of tug-of-war between two competing priorities – wealth and health.

While wealth does not directly purchase health, according to the U.S. Bureau of Labor Statistics (BLS), it certainly contributes. And, in a large-scale, global study, the American Psychological Association (APA) agrees that “wealth secures health.”

By providing a pre-taxed POP plan, you increase your employees’ wealth. In doing so, you make better health care coverage options more affordable for them. Increased coverage affordability improves the likelihood of them opting in favor of health-focused initiatives.

Providing a POP plan, then, can end that tug-of-war and allow your employees’ wealth and health to meet in the middle.

And, believe it or not, according to the Society for Human Resource Management (SHRM), employee performance and productivity are directly linked to a prioritization of health.

It’s just icing on the cake that this wealth-to-health balance can also amp up your business productivity.

4. A POP plan can strengthen your compensation package

When it comes to employee recruitment and retention, compensation is king.

Applicants and employees value the work they perform and, no doubt, want to receive a fair paycheck and competitive benefits for it.

Providing a POP plan covers both of those bases – it uses tax savings to simultaneously increase your employees’ disposable income while reducing the amount of it that they spend on their health care coverage. In this way, it strengthens your compensation package.

Where compensation is king, providing a POP plan to your employees may just be the crown jewel of your compensation package that will help you compete for and keep top talent in a difficult employment market.

5. A POP plan can stimulate employee satisfaction and reduce your turnover

Let’s recap a few of the ways in which a POP plan benefits your employees – with a POP plan in place, they will have:

- Less taxes

- More income

- Affordable access to better health care coverage options

What’s not to like? EXACTLY.

Providing a POP plan with such attractive employee benefits is a sure way to solidify employee satisfaction. And establishing employee satisfaction leads to employee engagement which, ultimately, drives employee loyalty.

With 87% of satisfied and engaged employees more likely to stay at their company, reduced turnover is a POP plan reward that you will reap.

Next steps to providing a POP plan as part of your benefits program

If you are here, you want to maximize your employee compensation package. But you also want to do that in a cost-effective way.

From tax-saving features that will entice your workforce to built-in recruitment and retention initiatives that will benefit you, providing a POP plan to your employees as part of their benefits package may be the solution you are looking for.

By reading this article, you learned 5 profitable perks of putting a POP plan in place.

Are you ready to get started? Our benefits experts here at Combined want to help you put together and implement your POP plan.

|

Schedule a meeting with a specialist today to learn more. |

|

If you are not yet ready to speak with a team member, you may find these resources helpful:

|

This article is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

Topics: